As our population ages, the need for long-term care services and caregiving assistance is becoming a pressing concern. Benefit brokers and employers are uniquely positioned to help Americans understand the need for long-term care planning and manage caregiving responsibilities. Advancements in technology offer tools that can aid in planning and preparing for these eventualities, helping to tell not just the why story, but the how.

Understanding the Cost of Care: Why It Matters

The cost of long-term care can be staggering and is often underestimated. According to the Genworth Cost of Care Survey 2023, the annual national median cost of an assisted living facility has risen to $64,200. Early and informed planning is vital for several reasons:

- Preparation for financial impact: Knowing potential costs allows for financial preparation through savings, insurance, or other means.

- Informed decision-making: Awareness of costs aids in choosing the type of care and location, balancing quality and affordability.

- Estate planning:Facilitates estate planning to ensure assets are allocated appropriately.

- Understanding government programs: Educates about eligibility for government assistance programs with financial thresholds.

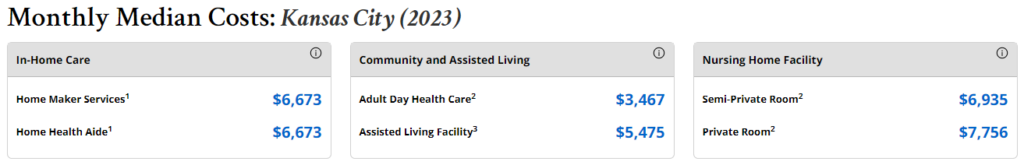

Genworth Cost of Care Report Tool: A Closer Look

The Genworth Cost of Care report tool is invaluable for understanding long-term care expenses. It provides a breakdown of costs by state and care setting, offering insights into median costs today and future projections. This tool helps in current planning and anticipating future expenses, allowing for a more robust long-term care strategy.

The example in the chart from the Genworth Cost of Care Survey tool shows the monthly median costs in Kansas City, MO. You can change locations and time periods that show hourly, daily, monthly, or annual costs.

Chart created with Genworth Cost of Care Survey.

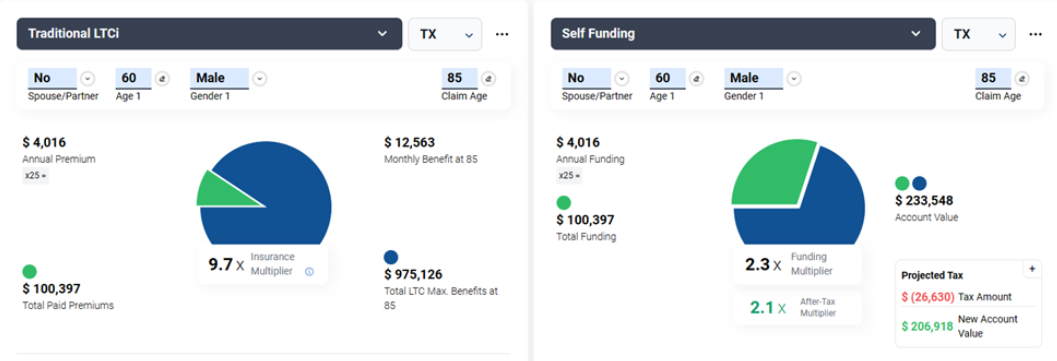

Benefit Buddy: Powerful Insurance Leverage Story

BuddyIns’ Benefit Buddy revolutionizes long-term care planning by helping individuals understand the leverage that long-term care insurance can provide. For example, for every dollar paid in premium, the policyholder could receive up to 9.7 times in insurance benefit, significantly reducing out-of-pocket expenses and providing financial security. This tool is available through a monthly membership with a 30-day free trial period.

Image created with the Benefit Buddy pre-quoting tool.

TCARE: High Touch, High Tech Caregiver Support

TCARE combines advanced data analytics, high-touch human support, and tailored interventions to create real results for caregivers and their families. It reduces caregiver burnout by helping navigate the complexities of care. Leveraging TCARE’s digital tools with a human-touch approach addresses workforce pressures by reducing time away from work, supporting retention of working caregivers, improving overall health and well-being, and supporting DEI initiatives. TCARE is provided to employers at a per-employee cost.

The Role of Technology in Personalizing Long-Term Care Planning

Technology’s greatest strength lies in its ability to personalize the process, whether it’s caregiving or long-term care planning. With tools like the Genworth Cost of Care report, Benefit Buddy, and TCARE, the experience meets people where they are and gives them tailored information and projections. This personalized approach ensures that each person’s unique needs and preferences are considered, leading to a more accurate and effective way of planning and managing a long-term care event.

Whether at the individual level or through employer-sponsored initiatives, technology serves as a beacon, guiding us through the intricate landscape of long-term care planning. By leveraging these advancements, we can safeguard our dignity, independence, and financial well-being in the years to come, ensuring that our long-term care journey is one of empowerment and informed choice.